Best Travel Credit Cards: Maximizing the Benefits

How to Choose the Best Credit Card for Your Family | A Comparison of the Top Cards for Frequent Flyers

Hey there, fellow globetrotters! If you're anything like me, you live for that feeling of stepping off a plane and exploring someplace new. But let's face it, traveling can get expensive, especially with kids, which is why having the right credit card can make all the difference. Today, we're going to compare the best credit cards for frequent travelers. So buckle up and let's get started!

This article contains affiliate links to products I feel good about endorsing, meaning I may earn commission from qualifying purchases. Check disclaimers for more info.

Chase Sapphire Reserve

Our personal favorite: First up, we have the Chase Sapphire Reserve. This card is the Rolls Royce of travel credit cards, with a $550 annual fee, but it's worth it if you travel frequently. With a 60,000-point sign-up bonus (worth $900 when applied to travel) and 3X points on travel and dining, this card is a favorite for our family and our jet-setting travel companions. It comes with a $300 annual travel credit which brings the annual fee effectively down to $250.

Pro-tips for maximizing your rewards

- Book airfare and hotels through the Chase Ultimate Rewards portal for 5x or 10x points. Don't forget to use this hack to get refunds or airfare credit if the prices drop!

- Earn 10x points when you order takeout or make prepaid dining reservations through Chase Ultimate Rewards.

- Redeem your points for travel and they are worth 50% more than cash back.

- Download the Priority Pass app and check for participating lounges wherever you fly. Don't underestimate the power of free alcohol and snacks to offset a long layover or travel delays.

- Skip the long lines at security and get up to $100 statement credit every 4 years for Global Entry or TSA PreCheck® or NEXUS Application fees.

- Keep an eye out for other rotating perks and benefits. Currently Instacart, DoorDash, and Lyft users can all experience extra benefits.

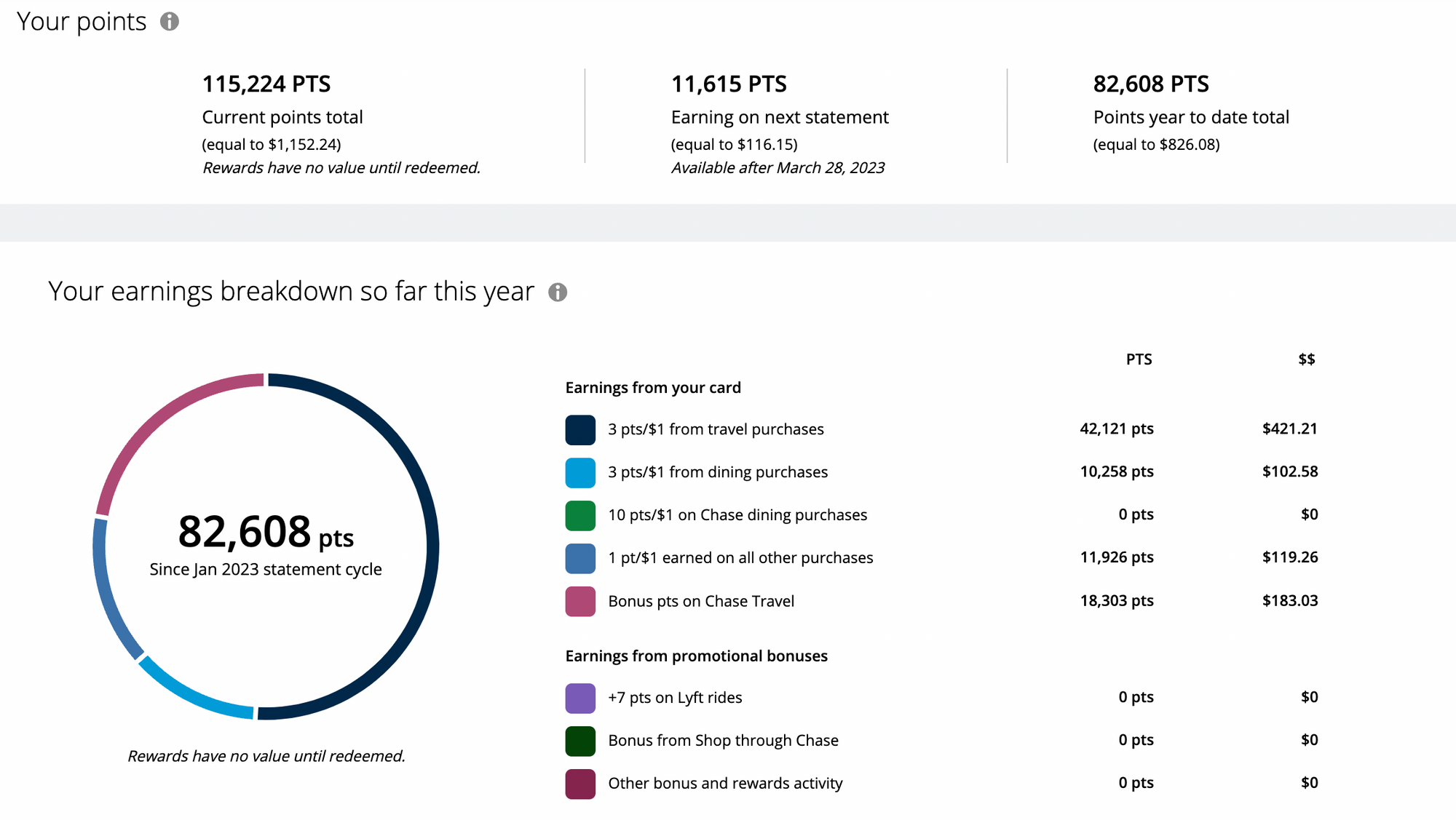

Using the tips above, we've easily offset the hefty annual fee every year. You can see from our current earnings breakdown that in the first quarter of 2023 we have already earned enough to offset over $1700 in travel.

Benefits for Added Peace of Mind

When we book our trips with our Chase travel cards we never have to purchase additional travel insurance. When our flights back to New York were cancelled due to hurricanes, we had no trouble getting reimbursed for the extended hotel stay and expenses thanks to Trip Cancellation/Trip Interruption protection. This year when our rental minivan got scraped exiting the parking garage we were also protected by the Auto Rental Collision and Damage waiver. These are perks you hope to never have to use, but are grateful to have when bad things happen!

American Express Platinum Card

Best Sign-On Bonus: Next on the list is the American Express Platinum Card. This card has a $695 annual fee, but it currently offers a 80,000-point sign-up bonus (that's about $800 in value). It also offers 5X points on flights booked directly with airlines or through American Express Travel. The Platinum Card also comes with a $200 airline fee credit and access to the Amex Global Lounge Collection. It's best for travelers who value luxury and perks and don't mind paying a premium for them.

Capital One VentureOne

No annual fee: If you're looking for a card with no annual fee, then the Capital One VentureOne Rewards card is a great option. With 1.25 miles per dollar on every purchase, and 5 miles per dollar spent on hotels or rental cars booked through their travel portal, this one served us well until we were ready to go full baller mode with Chase. Like all the others mentioned here it has no foreign transaction fees and comes with a 20,000-mile sign-up bonus.

Citi Premier

Best value: Last but not least, we have the Citi Premier Card. This card has a $95 annual fee, but it offers a 60,000-point sign-up bonus and 3X points on travel, gas, groceries, dining, and entertainment. The $100 annual hotel reimbursement offsets the annual fee right off the bat and gives it a slight edge over Chase Sapphire Preferred. It's best for travelers who want to earn higher rewards on everyday purchases without paying a premium annual fee.

So, there you have it, folks, the best credit cards for frequent travelers. Each card has its own unique benefits and is best suited for different types of travelers. Whether you value luxury, rewards, or a low annual fee, there's a credit card out there for you. Happy travels!

Comments ()